If you haven’t reviewed your home loan in a couple of years, we need to talk. You could be saving thousands of dollars and cutting years off your loan simply by spending a little bit of time comparing your options.

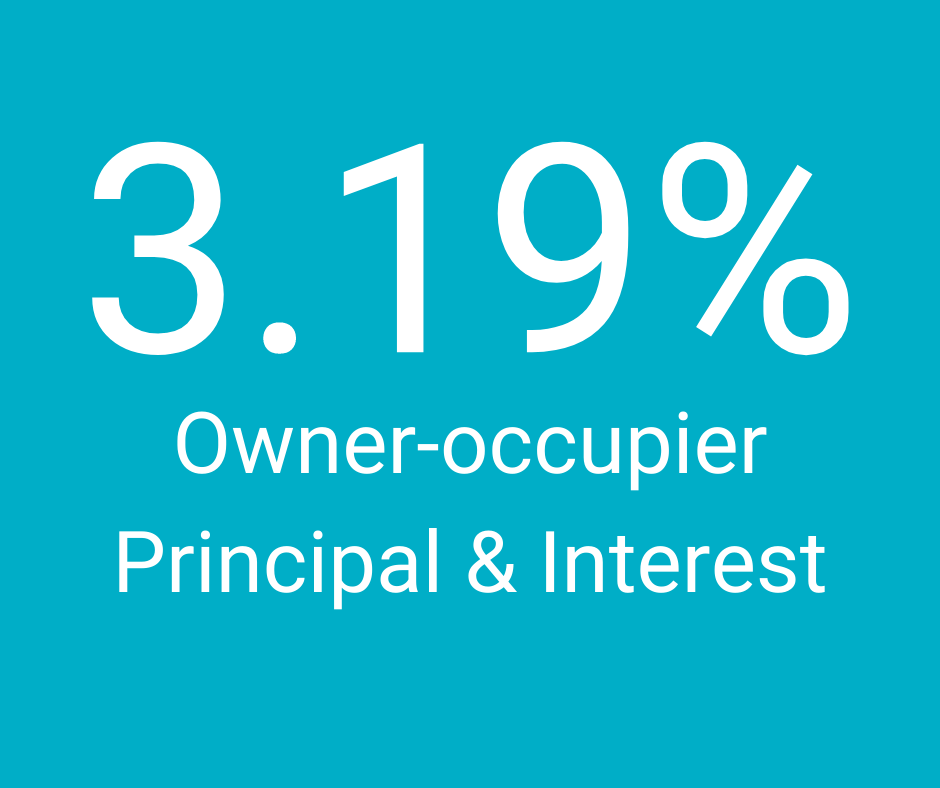

Interest rates currently start at 3.19% for owner-occupier, principal and interest. If your rate is higher than this, call me!

While the interest rate is a big factor when it comes to reviewing your loan, we also need to look at a couple of other things:

- type of loan

- features of the loan

- your eligibility to re-finance

The types of loans available are:

- Variable rate home loan

- Fixed rate home loan

- Split rate home loan

- Low deposit home loan

- Investment loan

- Offset home loan

They all have their pros and cons, so we need to make sure you choose the one that best suits your circumstances now and plans for the future.

With regards to the features of the loan, you may be interested in the ability to make extra repayments, redraw on your loan, access an offset account and split loan functionality. You may also want to check the fees payable. Do you know the options available? We can give you a run-through if you need some direction here.

Your eligibility is a big one here because the banks won’t lend to you if you’re not considered to be a good risk. You need to be able to demonstrate that you have the ability to service the loan, have a reliable, stable income and good credit history.

Do yourself a favour – if your loan is a couple of years old, dig out your latest statement or log into your home loan and check the interest rate. If it starts with a 4, call me.

If your loan is less than a couple of years old, there could be clawback fees payable which we want to avoid.

Home loans and investment loans aren’t a “set and forget” type of thing. Taking an active interest can really pay off.